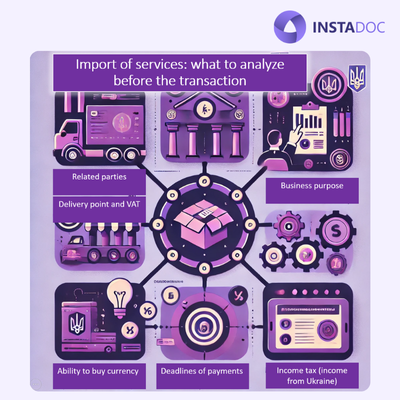

Importing services to Ukraine: key aspects that need to be analyzed before making a transaction

The import of services always raises many questions, because they have an intangible result, it is difficult to assess their relevance and value, and the exchange control system itself is subject to constant changes and is sensitive to global economic circumstances. So what are the key aspects that a lawyer should analyze, in addition to drawing up the contract itself.

The import of services always raises many questions, because they have an intangible result, it is difficult to assess their relevance and value, and the exchange control system itself is subject to constant changes and is sensitive to global economic circumstances. So what are the key aspects that a lawyer should analyze, in addition to drawing up the contract itself.

1) Relationship between the customer and the contractor

If there is a direct or indirect relationship between the parties, then this has the effect that the transaction may be considered controlled and a Report on controlled transactions must be submitted by October 10 of the following year. (but there are limits)

2) Availability of a business purpose

Like any transaction, importing services must have a clear business purpose. Basically, this makes it possible to attribute the amount of costs for ordering services of a non-resident to expenses.

3) Possibility of buying currency for payment

According to paragraphs 2 p. 14 of NBU Resolution 18 :

Authorized institutions are prohibited from carrying out cross-border transfers of currency values from Ukraine/transfers of funds to correspondent accounts of non-resident banks in hryvnias/foreign currency opened in resident banks, including transfers carried out on behalf of clients, except for the following cases:

...remittances by residents for operations on the import of goods (including the payment of fines, penalties, bonuses, reimbursement of related costs in connection with the execution of a foreign economic agreement, compensation for losses in connection with the non-execution of a foreign economic agreement) provided that the supply of goods under such operations carried out/carried out after February 23, 2021. The limitation on the term of delivery of goods for operations on the import of goods, defined in subparagraph 2 of paragraph 14 of this resolution, does not apply to transfers carried out at the expense of state budget funds;

It is interesting that in this context, goods are products, goods, works, services, property rights (more details https://i.factor.ua/ukr/journals/nibu/2022/december/issue-99/article-123432.html)

Therefore, based on the above, as of the date of this publication, it is not prohibited to buy currency for settlements with non-residents.

4) Settlement deadlines

If you make an advance payment (advance payment) or (guarantee payment) for the services of a non-resident, the services themselves must be provided within 180 calendar days, which must be confirmed by the relevant act.

14-2. The settlement deadlines for operations on the export and import of goods are 180 calendar days and apply to operations carried out from April 5, 2022.

5) It is necessary to determine tax liabilities from income tax (repatriation tax)

We determine whether a Convention on the avoidance of double taxation has been concluded between Ukraine and the country of tax residence of the performer, and whether such a country is included in the list of countries with low taxation. We determine the applicable rules, but as a rule, income tax will be paid by the performer in his own country, unless it is a low-tax jurisdiction.

But the application of this provision requires the non-resident executor to provide a certificate of tax residency duly certified (apostille or legalization). The original must be in the documents of the customer (a resident of Ukraine), otherwise the customer is obliged to calculate and pay the non-resident income tax on income originating in Ukraine.

103.4. The basis for exemption (reduction) from taxation of income with a source of origin in Ukraine is the submission by a non-resident, taking into account the features provided for in clauses 103.5 and 103.6 of this article, to the person (tax agent) who pays him the income, certificates (or a notarized copy thereof), which confirms that the non-resident is a resident of the country with which Ukraine has concluded an international agreement (hereinafter referred to as the certificate), as well as other documents, if this is stipulated by the international agreement of Ukraine.

103.5. The certificate is issued by the competent (authorized) body of the relevant country, defined by the international treaty of Ukraine, in the form approved in accordance with the legislation of the relevant country, and must be properly legalized, translated in accordance with the legislation of Ukraine.

103.6. If necessary, such a certificate may be requested from a non-resident by a person who pays him income, or by a controlling body during consideration of the issue of returning the sums of overpaid monetary obligations on another date preceding the date of payment of income.

If necessary, a person who pays income to a non-resident may apply to the supervisory authority at his location (place of residence) regarding the execution by the central executive authority implementing the state tax policy of a request to the competent authority of the country with which Ukraine has concluded an international agreement for confirmation information specified in the certificate.

{Paragraph two of Clause 103.6 of Article 103 as amended in accordance with Laws No. 5083-VI dated 07.05.2012 , No. 1797-VIII dated 21.12.2016 }

103.7. When legal entities - residents of Ukraine carry out transactions with foreign banks related to the payment of interest, confirmation of the fact that such a foreign bank is a resident of the country with which Ukraine has concluded an international agreement is not required, if this is confirmed by an extract from the international catalog "International Bank Identifier Code" (published by SWIFT, Belgium International Organization for Standardization, Switzerland).

{Clause 103.7 of Article 103 as amended in accordance with Law No. 2245-VIII dated 07.12.2017 }

103.8. A person who pays income to a non-resident in the reporting (tax) year, if the non-resident submits a certificate with information for the previous reporting tax period (year), may apply the rules of the international treaty of Ukraine, in particular regarding exemption (reduction) from taxation, in the reporting (tax) year upon receipt of the certificate after the end of the reporting (tax) year.

103.9. A person who pays income to a non-resident is obliged, in the case of payments to non-residents with their source of origin from Ukraine, in the reporting period (quarter), to submit to the supervisory body at his location (place of residence) a report on the income paid, taxes withheld and transferred to the budget for incomes of non-residents within the terms and in the form established by the central executive body, which ensures the formation and implementation of state financial policy.

{Clause 103.9 of Article 103 as amended in accordance with Law No. 1797-VIII dated 12.21.2016 }

103.10. In the event that a non-resident does not submit a certificate in accordance with clause 103.4 of this article, the income of a non-resident with a source of origin in Ukraine shall be subject to taxation in accordance with the legislation of Ukraine on taxation.

6) It is necessary to determine the place of supply of services and, accordingly, tax obligations from value added tax

The tax code of each country imperatively determines the place of supply of services and does not give the parties to the contract the right to choose.

186.2. The place of supply of services is:

186.2.1. the place of actual supply of services related to movable property, namely:

a) services that are auxiliary to transport activities: loading, unloading, transshipment, warehouse processing of goods and other similar types of services;

b) services for carrying out examination and assessment of movable property;

c) services related to the transportation of passengers and cargo, including the supply of food and beverages intended for consumption;

d) services for the performance of repair works and services for the processing of raw materials, as well as other works and services related to movable property;

186.2.2. the actual location of real estate, including that under construction, for those services related to real estate:

a) services of real estate agencies;

b) services for the preparation and implementation of construction works;

c) other services based on the location of real estate, including under construction;

186.2.3. the place of actual provision of services in the field of culture, art, education, science, sports, entertainment or other similar services, including the services of organizers of activities in the specified areas and services provided for arranging paid exhibitions, conferences, educational seminars and other similar events.

186.3. The place of delivery of the services specified in this point is considered to be the place where the recipient of services is registered as a business entity or - in the absence of such a place - the place of permanent or primary residence. Such services include:

a) provision of property rights of intellectual property, creation by order and use of objects of intellectual property rights, including under license agreements, as well as provision (transfer) of the right to reduce greenhouse gas emissions (carbon units);

b) advertising services;

c) consulting, engineering, engineering, legal (including legal), accounting, auditing, actuarial, as well as software development and testing services, data processing and consulting on informatization, providing information and other services in the field of informatization , including using computer systems;

{Subparagraph "c" of Clause 186.3 of Article 186 as amended in accordance with Laws No. 3609-VI dated 07.07.2011 , No. 1914-IX dated 30.11.2021 }

d) providing staff, including if the staff works at the buyer's place of business;

e) providing for rent, leasing of movable property, except vehicles and bank safes;

{Subparagraph "g" of Clause 186.3 of Article 186 as amended in accordance with Law No. 1605-IX dated 01.07.2021 }

e) telecommunication services, namely: services related to the transmission, distribution or reception of signals, words, images and sounds or information of any nature using wire, satellite, cellular, radio, optical or other electromagnetic communication systems , including the corresponding provision or transfer of the right to use the possibilities of such transmission, distribution or reception, including the provision of access to global information networks;

f) radio broadcasting and television broadcasting services;

g) provision of intermediary services on behalf and at the expense of another person or on one's own behalf, but at the expense of another person, if provision of the services listed in this item is ensured to the buyer;

{Subparagraph "is" of Clause 186.3 of Article 186 as amended in accordance with Law No. 466-IX dated 16.01.2020 }

g) provision of transport and forwarding services;

h) provision of services for the production and composition of video films, motion pictures, animated (animated) films, television programs, advertising films, photo-advertising materials and computer graphics;

{Clause 186.3 of Article 186 was supplemented by subparagraph "z" in accordance with Law No. 821-IX dated 07.21.2020 }

i) services for access to the capacity of interstate crossings (physical transmission rights) and auxiliary services defined by the Law of Ukraine "On the Electric Energy Market".

{Clause 186.3 of Article 186 was supplemented by subparagraph "y" in accordance with Law No. 3219-IX dated 30.06.2023 }

Here, for example, the place of dispatch of legal and consulting services is the place of registration of their recipient, that is, when importing consulting services, the customer must register the PN and pay VAT.

If you have any questions or concerns about your transaction, we are happy to consult and talk .

Date of publication: 14.10.2024