How to confirm the status of tax residency online (+ application templates for confirmation of residency status to avoid double taxation)

.png) Persons who stay in another country for more than 183 days risk being subject to double taxation of their income.

Persons who stay in another country for more than 183 days risk being subject to double taxation of their income.

First of all, it should be noted that according to subsection 213, paragraph 1 of Article 14 of the Tax Code of Ukraine , a resident natural person is a natural person who has a place of residence in Ukraine. If a natural person also has a place of residence in a foreign country, he is considered a resident, if such a person has a place of permanent residence in Ukraine; if a person has a place of permanent residence also in a foreign country, he is considered a resident if he has closer personal or economic ties (center of vital interests) in Ukraine. If the state in which an individual has a center of vital interests cannot be determined, or if an individual does not have a place of permanent residence in any of the states, he is considered a resident if he stays in Ukraine for at least 183 days (including the day of arrival and from 'ride) during the period or periods of the tax year.

At the same time, in accordance with Clause 13.3 of Article 13 of the Tax Code of Ukraine , which regulates the elimination of double taxation, income received by a resident natural person from sources outside Ukraine are included in the total annual taxable income, except for income that is not subject to taxation in Ukraine in accordance with the provisions of this Code or an international treaty, the consent of which is binding has been given by the Verkhovna Rada of Ukraine.

In order to avoid double taxation, a tax resident of Ukraine must confirm the status of a tax resident of Ukraine and a tax payer in Ukraine.

In order to apply international treaties of Ukraine on the avoidance of double taxation of legal entities and natural persons of Ukraine who receive income outside of Ukraine, the Ministry of Finance of Ukraine has developed a form of certificate confirming the status of a tax resident of Ukraine to avoid double taxation in accordance with the norms of international treaties and the Procedure for confirming the status of a tax resident resident of Ukraine to avoid double taxation in accordance with the norms of international treaties (hereinafter referred to as the Procedure) .

Thus, according to clause 2 of the Procedure , the provision of a Certificate or confirmation of the status of a tax resident of Ukraine on documents using special forms approved by foreign competent authorities is carried out free of charge on the basis of the taxpayer's application in the form given in the appendix to this Procedure (hereinafter - the Application).

In accordance with Clause 3 of the Procedure , the application is submitted by the taxpayer (authorized representative) to the supervisory body at the main place of registration, and in the case of submission of the Application for the Certificate by taxpayers - by natural persons who are temporarily outside their place of residence or do not have a permanent place of residence residence, - to any controlling body. The application may be submitted at the taxpayer's option by means of electronic communication in electronic form in compliance with the requirements established by Section II of the Code.

The controlling body verifies the data specified in the Application , in particular for compliance with the Code and the relevant international treaty of Ukraine. The taxpayer can provide documents and information confirming the grounds specified in the Application for determining his status as a resident of Ukraine in order to avoid double taxation ( clause 4 of the Procedure ).

A certificate or a reasoned refusal to issue it is issued with the signature of the head of the supervisory body (his deputy or an authorized person) within ten calendar days from the date of receipt of the Application ( clause 5 of the Procedure ).

The following may be grounds for refusing to issue a Certificate:

1) a person cannot be recognized as a resident of Ukraine in accordance with the criteria specified in subsection 14.1.213 of clause 14.1 of Article 14 of the Code;

2) there is no data on registration in the Unified State Register of legal entities, individual entrepreneurs and public formations for legal entities or individual entrepreneurs;

3) there is no data on registration in the State Register of natural persons - taxpayers for natural persons;

4) inconsistency of the information specified in the Application, in particular the registration data of a legal entity or individual, with the data available in the information systems of the controlling body;

5) the documents were submitted by a person who does not have the authority to do so;

6) a foreign company with a place of effective management on the territory of Ukraine has not acquired or renounced the status of a tax resident of Ukraine in accordance with subparagraph 133.1.5 of clause 133.1 of Article 133 of the Code.

The certificate is provided at the choice of the payer in paper or electronic form, which he notes in the Application. The payer receives the certificate in electronic form in the private part of the electronic cabinet in compliance with the requirements established by Section II of the Code.

A convenient way of such confirmation is, of course, to submit a corresponding application online.

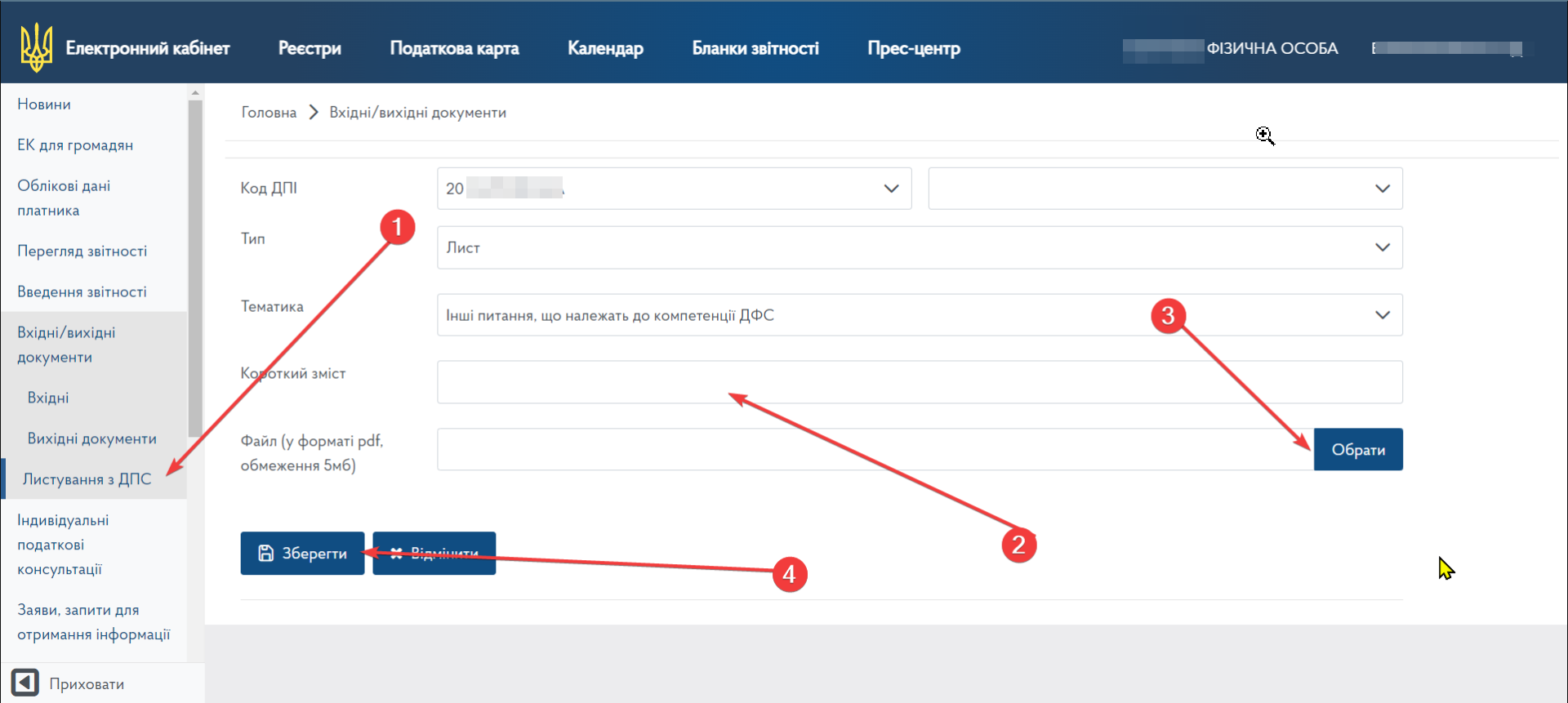

Online submission of the application is implemented through the electronic account of the taxpayer in . To do this, we go to the Electronic cabinet with the help of an electronic digital signature (KEP). We pre-fill the Application for confirmation of resident status to avoid double taxation and save it in PDF format (limit 5 MB). Next, in the taxpayer's electronic account, on the left, we find correspondence with the DPS. Next, fill in the necessary fields:

- DPI code - choose the required DPI

- type - sheet

- subject - other issues that belong to the competence of the SFS

- summary - for example, Application for confirmation of resident status

- file - download the previously completed application (PDF format, up to 5 MB).

- Next, you need to click "Save", sign and send.

Information on receiving and registering letters can be viewed in the "Incoming/Outgoing Documents" tab.

Along with the online submission, of course, it remains to submit such an application by mail or personally apply to the supervisory authority.

You can create an Application for confirmation of resident status to avoid double taxation in the Instaco designer by following the link .

Also, we offer a free version of the above Application , on the basis of which the controlling authorities issued a certificate confirming the status of a tax resident of Ukraine to avoid double taxation .

You can choose any application option, however, remember that it is the Application for Confirmation of Resident Status to Avoid Double Taxation is the established form of such a document.

To create a statement, you only need to enter the necessary data in the Instaco designer.

Date of publication: 26.01.2023